SETTING THE RECORD STRAIGHT

FACTS ABOUT LIVE NATION ENTERTAINMENT

STATEMENT FROM LIVE NATION ENTERTAINMENT

The DOJ’s lawsuit won’t solve the issues fans care about relating to ticket prices, service fees, and access to in-demand shows. Calling Ticketmaster a monopoly may be a PR win for the DOJ in the short term, but it will lose in court because it ignores the basic economics of live entertainment, such as the fact that the bulk of service fees go to venues, and that competition has steadily eroded Ticketmaster’s market share and profit margin. Our growth comes from helping artists tour globally, creating lasting memories for millions of fans, and supporting local economies across the country by sustaining quality jobs. We will defend against these baseless allegations, use this opportunity to shed light on the industry, and continue to push for reforms that truly protect consumers and artists.

- Live Nation and Ticketmaster’s annual 1.4% annual net profits are the opposite of monopoly power.

- There is more competition than ever in the live events market – which is why Ticketmaster’s market share has declined since 2010.

- This lawsuit distracts from real solutions that would decrease prices and protect fans – like letting artists cap resale prices.

LEGAL ANALYSIS

Breaking down the DOJ Lawsuit

“It ignores everything that is actually responsible for higher ticket prices, from increasing production costs to artist popularity, to 24/7 online ticket scalping that reveals the public’s willingness to pay far more than primary tickets cost.”

Further analysis will be forthcoming. Check back for updates.

Setting The Record Straight on the 2010 Live Nation-Ticketmaster Merger

“In today’s primary ticketing market, venues are able to organize robust competitive bidding among Ticketmaster, SeatGeek, AXS and others so that if they choose Ticketmaster — the product that a large majority of venues want to buy — they get Ticketmaster at highly competitive prices. Those are simply the facts. And they do not describe a monopolized market.”

How Secondary Sites Misuse Antitrust to Protect Their Business

“If the government wants to take action that genuinely helps consumers – which is to say, fans – it should pass federal legislation, preempting contrary State legislation, giving artists, sports teams and other event organizers clear rights to set the resale rules for their shows.”

The Truth About Ticket Prices

“Tickets are actually priced by artists and teams…It’s their show, they get to decide what it costs to get in. Fans are also told that service charges are Ticketmaster’s way of raising ticket prices. In fact, Ticketmaster does not set service charges, venues do, and most of the money goes to the venues.”

FACT CHECK

The merger between Live Nation and Ticketmaster has been a topic of intense debate and frequent misinformation. This Fact Check clarifies commonly misreported facts, providing accurate information and context.

Myth #1

Ticketmaster doesn’t innovate and is “too big to care” which is what led to issues during the Eras tour onsale in November 2022.

Fact

The issues during this onsale were caused by a novel cyber-attack. While the bots failed to penetrate our systems or acquire any tickets, the attack required us to slow down and even pause our sales. Our engineers working behind the scenes built new defenses in real-time, and sales were ultimately able to progress later in the day.

More Facts

- As Billboard reported, “Ticketmaster was so good at blocking brokers that it unintentionally created a seller’s market for fans looking to unload tickets for 10 times face value.”

- Ticketmaster is continually innovating its technology in the ongoing arms race against bot-powered scalpers. More than $1 billion has been invested in Ticketmaster’s platform improvements, fraud protections, and bot-fighting technology since it merged with Live Nation in 2010.

- Resale is a multi-billion-dollar industry in the U.S. – meaning scalpers are highly sophisticated and well financed. Ticketmaster is in an ongoing tech arms race. As we create new defenses, they continue to find ways to cheat the rules. Bot attacks are not novel to ticketing, are increasing in frequency as AI advances, and now plague other online goods and services, including restaurant reservations, sneaker sales, golf tee times, and more.

- We believe artists should be able to limit the resale prices on the tickets to see their art. This would help get more affordable tickets to more fans by reducing scalper incentives to acquire and markup tickets while also devaluing the bot attacks.

Sources:

- Politico | Ticketmaster says cyberattack disrupted Taylor Swift ticket sales

- Axios | Why you can’t find cheap Taylor Swift concert tickets

- Senate Judiciary Archive | Live Nation Testimony

- Billboard | Taylor Swift’s Biggest Scalper for the Eras Tour: Her Fans

- Wall Street Journal | Taylor Swift’s Tour Is Wreaking Havoc on Ticket Reselling

- The New Yorker | Why You Can’t Get a Restaurant Reservation

Myth #2

Ticketmaster sets ticket prices and is responsible for price gouging.

Fact

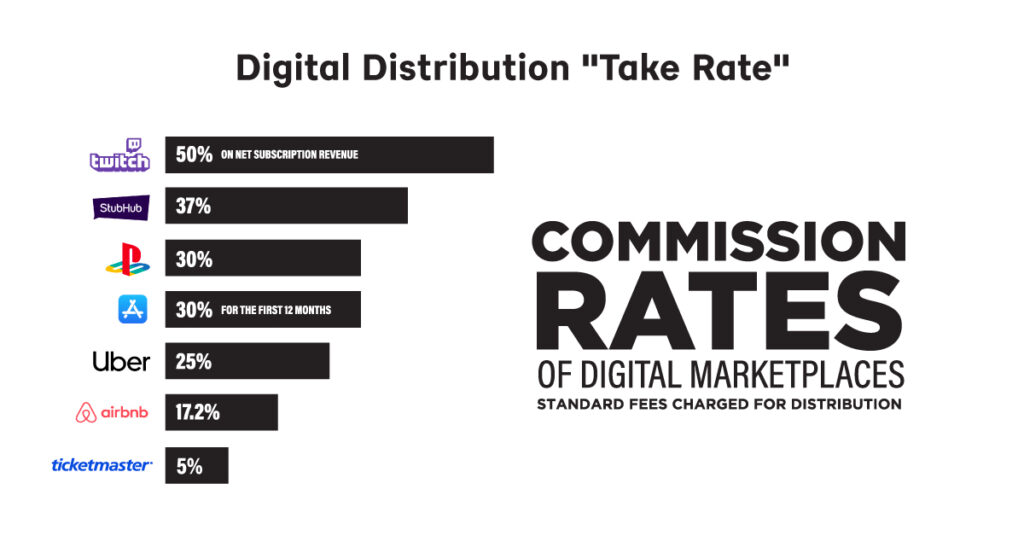

Primary ticketing companies like Ticketmaster do not set ticket prices. Tickets are generally priced by artists and teams. It’s their show, they should determine the price of their tickets. A primary ticketing company only gets about 5% of the total transaction, a figure far too low to be the cause of high-ticket prices.

More Facts

- Sports tickets are normally priced by the home teams. Concert tickets are generally priced by the artist’s business teams. Tickets to spectacles like Monster Jam or Cirque du Soleil are priced by the producer. Ticketmaster does not set the ticket prices for primary tickets, and on resale marketplaces prices are always set by the ticket seller.

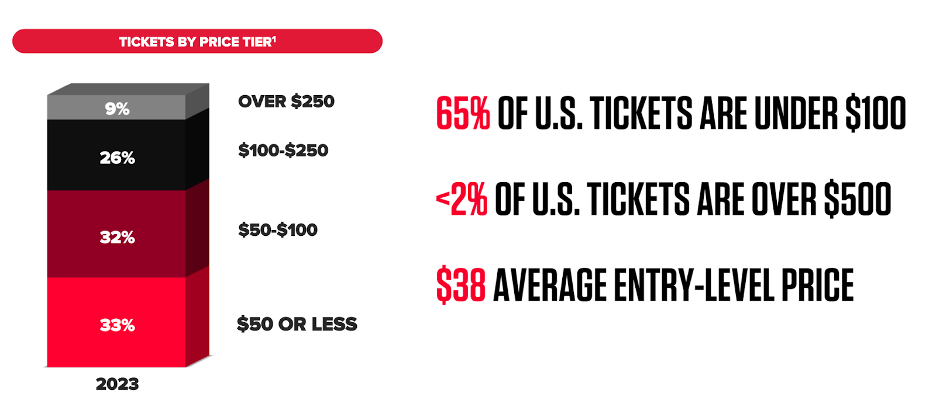

- While prices for front row seats get all the press headlines, the majority of artists are pricing their tickets well under market value – in fact 65% of tickets for U.S. concerts are under $100.

- Resale heavily contributes to increased prices, with average resale prices double the original ticket price set by the artist.

Sources:

- Live Nation News Site | The Truth About Ticket Pricing

Myth #3

Ticketmaster keeps 100% of ticketing service fees.

Fact

Most fees go back to the venue – they typically keep over two-thirds of the service fee. Ticketmaster’s commission is usually about 5% of the all-in price paid by the consumer. So, on a $100 all-in ticket, Ticketmaster gets $5. Venues use their majority share of service charges to help cover the costs of operating the facility and hosting shows, including expenses for staffing, security, venue improvements and more.

More Facts

- A typical contract will provide that in exchange for its services and some guaranteed cash payments to the venue, the ticketing company will get a stated percentage of the service charge the venue intends to impose.

- If fees add 30% to the face value of a ticket, the primary ticketing company is getting something in the range of 5% of the all-in price – which is much lower than the distribution cost of other online platforms. This 5% isn’t pure profit. The ticketing company has various expenses it needs to cover, including guaranteed payments to venues and the development and deployment of its technology platform. A primary ticketing company’s profit per ticket is closer to 2% of the average ticket price, a figure far too low to be the cause of high-ticket prices.

Sources:

Myth #4

Ticketmaster wants to hide fees.

Fact

We strongly believe there should be an all-in pricing law in the U.S. so on all ticket marketplaces consumers see the full cost upfront including the face value + fees. Live Nation’s venues and festivals already moved to all-in pricing in Fall 2023.

More Facts

- Live Nation’s U.S. venues and festivals moved to all-in pricing in Fall 2023 and have seen an 8% increase in purchase conversion rate from fewer cart abandonments – indicating all-in pricing is both good for consumer transparency and helping artists sell more tickets.

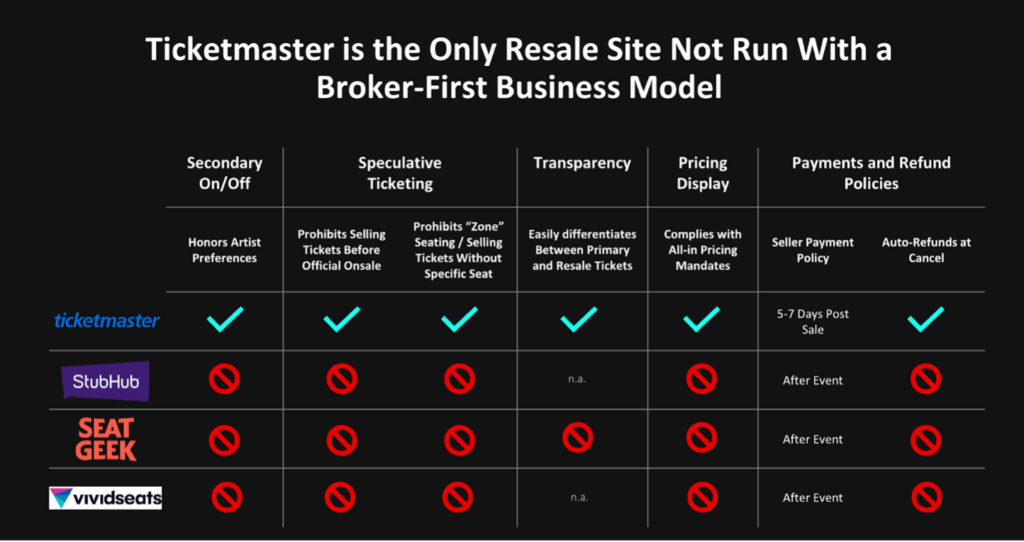

- Ticketmaster complies with all-in pricing in states that already legally require it, including Connecticut, New York and Tennessee. Unfortunately, we routinely see resale sites defy state laws requiring all-in pricing which confuses and harms fans. We strongly encourage regulatory scrutiny to ensure compliance across the industry.

- Outside these jurisdictions, it’s up to the venue how their fees are displayed. Ticketmaster encourages its venue clients to display all-in pricing and offers a toggle for fans where it’s not already the default display.

Sources:

Myth #5

Ticketmaster opposes ticketing reforms.

Fact

Live Nation and Ticketmaster have long supported robust all-in pricing rules, banning speculative ticket selling and other predatory resale practices, enhancing anti-bot legislation and giving artists the right to determine how their tickets are resold. The company proactively advocates for these reforms at the state and federal levels.

More Facts

- Live Nation along with a broad coalition of artists and artist managers are calling on policymakers to adopt the commonsense policy changes outlined in FAIR Ticketing Reforms to improve live event ticketing for fans and artists.

- Live Nation applauds House lawmakers for taking the first step to pass the TICKET Act. The bipartisan bill requires the full cost of event tickets to be disclosed to consumers upfront, bans speculative ticket selling, and requires the FTC to study and report on enforcement of the 2016 BOTS Act. Live Nation also supports ticketing reform bills currently proposed in the Senate, including the Fans First Act and the TICKET Act.

- Live Nation put its advocacy agenda into action by leading the industry in adopting all-in pricing at its U.S. venues and festivals in Fall 2023. The company vigorously supports a national law to ensure everyone follows this policy to the benefit of fans and artists.

Sources:

Myth #6

Ticketmaster allows bots to get tickets to make more money on the resale of the ticket.

Fact

Ticketmaster’s singular goal regarding bots is to stop them, period. Ticketmaster invests more than everyone else in the industry combined to prevent bots from acquiring tickets intended for real fans. The problem is not Ticketmaster’s level of effort, but the arms race with bad actors whose only incentive is to constantly develop new methods of using bots use to circumvent Ticketmaster security.

More Facts

- As Axios reported, “Ticketmaster developed ‘Face Value Ticket Exchange’ originally for one-time foe Pearl Jam, for a tour that was announced just weeks before the COVID-19 pandemic. It’s since been used by other artists, including The Cure and Paramore. The basic idea is that ticketholders can only resell via the Ticketmaster platform, and only for what they originally paid. Neither Ticketmaster nor the artists receive a cut of the secondary sales.”

- Ticketmaster is the only resale site not run with a broker-first business model. Instead, Ticketmaster is guided by Live Nation’s artist-first approach which focuses on supporting artists’ careers and improving the live event experience for their fans. As a result, resale is a small part of Ticketmaster’s overall business, as the platform’s core focus is primary sales that benefit content owners like artists and sports teams. In fact, the majority of the secondary transactions Ticketmaster is accused of encouraging actually benefit other companies, not Ticketmaster.

- Ticketmaster acknowledges resale—done right—can benefit consumers by offering flexibility to recoup their money if they can no longer attend a show. Ticketmaster’s resale marketplace operates to a higher standard by banning speculative ticketing and offering Verified Resale, which guarantees fans get in the door, while other resellers like SeatGeek and StubHub just give refunds when tickets don’t work, leaving the fan shut out of the show.

- Ticketmaster’s Face Value Fan-to-Fan Exchange, which was originally developed for Pearl Jam, has recently been used by artists including Hozier, Cigarettes After Sex, Noah Kahan, Foo Fighters, Pearl Jam, Wilco, PJ Harvey, Ben Howard, Luke Combs, Norah Jones, Something Corporate, Billie Eilish and more.

Sources:

- Axios | Why you can’t find cheap Taylor Swift concert tickets

- Senate Judiciary Archive | Live Nation Testimony

Myth #7

Ticketmaster has no competition.

Fact

Most large venues in the U.S. (stadiums and arenas) are owned and operated by major sports teams, who make the ticketing decisions for their venues. Ticketmaster does not control any of them.

More Facts

- At the time of the merger, Ticketmaster had very little competition. Today, there are more competitors in every part of the primary ticketing market.

- Leading primary ticketing competitors for large venues like stadiums and arenas:

- SeatGeek

- AEG’s AXS

- Paciolan

- Leading primary ticketing competitors for smaller venues like clubs and theaters:

- SeeTickets

- Eventim

- Etix

- DICE

- SecuTix

- Tessitura

- Eventbrite

- Additionally, the secondary market continues to grow faster than primary:

- StubHub

- SeatGeek

- Viagogo

- Vivid Seats

- And more

Sources:

Myth #8

Ticketmaster “controls” ticketing at many large venues across the country.

Fact

Many large venues in the U.S. are owned and operated by major sports teams, who are in charge of ticketing protocols at their venues.

More Facts

- Many of these venues select Ticketmaster as their ticketing vendor because it offers superior technology for the complex needs of large-scale venues. Platform benefits include the ability to handle multiple high demand onsales simultaneously, venue access control, box office assistance, and more.

- When venues need a ticketing service, they generally send out requests for proposals (RFPs) that presume there will be one and only one winner. Ticketing companies then go through several rounds of competitive bidding to win these contracts. The process is highly competitive and driven by detailed financial modeling and technology requirements.

- The financial aspects of these deals depend on fixed upfront payments (such as payments ticketers make to the venue for exclusivity), determining the split of ticketing fees between the venue and ticketing vendor, the expected annual gross ticket value, and the contract’s length.

- Besides the financial elements, venues also consider how well the ticketing system can manage complex tasks and the level of customer support the supplier offers. New state-of-the-art venues, with diverse seating types, VIP options, and connectivity requirements, need advanced technology solutions and strong support services to handle the demands of modern venues and events.

Myth #9

Ticketmaster uses venue exclusivity to defend its market share.

Fact

Venue exclusivity exists for two reasons: venues hardly ever want to have two primary ticketing companies, and exclusive contracting is the best way for them to get the best deals. In other words, exclusive contracting is not about Ticketmaster; it is what venues want.

More Facts

- Even if exclusive ticketing contracts were eliminated, it’s unlikely a venue would choose to use multiple ticketing providers.

- Given the complex venue integrations and staff training required, it’s more economical and operationally feasible for venues to choose a single ticketing provider. This is similar to how a restaurant wouldn’t use two different point-of-sale systems for handling orders and payments; they choose one, whether it be Square, Toast, or another system.

- Exclusive contracting creates a winner-takes-all bidding environment that forces ticketing companies to make the best offers they can. Its benefit effects for venues are clear in the steady increases in guaranteed money to venues and higher splits of service charges to venues.

ABOUT LIVE NATION ENTERTAINMENT

Company Overview + Financials

Live Nation Entertainment’s primary mission is to serve artists and support their live music careers.

- The company is comprised of four key segments:

- Concert Touring

- Venue Operations

- Sponsorships

- Ticketing

- While Live Nation Entertainment generates billions in revenue each year, these funds largely go directly to artist and venue clients. The overall profit margin of the collective business is small.

- Live Nation has diversified its revenue streams in order to grow its business, the most significant of which is its global sponsorship division which is the company’s highest profit margin segment.

Industry Leadership

Live Nation remains dedicated to leading the industry with artist and fan friendly operations and policies, including:

- Remaining the Largest Financial Supporter of Artists: Live Nation paid over $13 billion of artist costs in 2023 alone. Unlike the recorded industry, artists maintain full ownership of their live performances and keep the vast majority of touring revenues. Typically, more than 90% of ticket sales (less show costs) for Live Nation shows go directly to artists.

- Supporting Developing Artists: Live Nation launched On the Road Again to support developing artists in clubs with 100% merch profits, $1,500 nightly cash bonuses for gas and travel costs on top of their guarantee, and more. On the Road Again has distributed tens of millions of dollars to over 4,500 artists and counting. This program is particularly critical as touring remains the main income source for artists, especially as the prices developing artists are charging for their ticket prices typically hasn’t kept up with their rising tour costs.

- Leading Shift to All-in Pricing for Fans: Live Nation’s U.S. venues and festivals moved to all-in pricing in Fall 2023 and have seen an 8% increase in purchase conversion rate from fewer cart abandonments – indicating all-in pricing is both good for consumer transparency and helping artists sell more tickets. The company continues to advocate for a national mandate on all-in pricing, so consumers see the total cost they’ll pay right upfront, no matter where they buy tickets.

- Advocating for Ticket Reforms that Protect Fans + Artists: Live Nation and Ticketmaster proactively advocate for legislative policies that protect fans and artists. The company has long supported robust all-in pricing rules, banning speculative ticket selling and other predatory resale practices, enhancing anti-bot legislation and giving artists the right to determine how their tickets are resold. Learn more about Live Nation’s legislative advocacy.

- Stepping up to $20 Minimum Wage for Venue Crew: As part of ongoing efforts to support crew that work behind the scenes to make shows happen, Live Nation moved its club and theater staff up to a $20 minimum starting wage. These increases impacted more than 5,000 crew members who cover many different roles supporting shows including box office attendants, production crew, artist hospitality, guest services, ushers, parking attendants, cleaning crews, sustainability coordinators, and more. The new base wages are over 250% higher than the federal minimum wage and also exceed the highest state minimum wages including those in California, New York, Washington and the District of Columbia.

- Leading Tech Innovation: Since 2010, Live Nation has invested more than a $1 billion to improve Ticketmaster:

- Building modern computing architecture

- Pioneering digital ticketing to eliminate fraud

- Investing in anti-bot technology

Tech Innovation

Ticketmaster leads the industry in innovation, pioneering technologies to empower artists and make shows more accessible to their fans. The company invests heavily in protecting the artist-fan connection, spending hundreds of millions to combat bots so tickets get into the hands of real fans. As the bots arms race continues to escalate with advances in AI, it’s more critical than ever to implement ticket reforms to reduce scalping.

Ticketmaster’s industry-leading technologies focus on honoring the wishes of content owners and protecting fans:

- SafeTix: Introduced in 2019, SafeTix was developed to prevent fraud and give venues data regarding who attends their events. SafeTix uses rotating barcodes and other advanced security technologies to prevent duplication, essentially eliminating PDF ticket fraud overnight. The NFL was the first partner to trial digital ticketing with Ticketmaster, and in just a few years it has become the standard for the industry.

- Face Value Exchange: Developed for Pearl Jam in 2019, Ticketmaster’s Face Value Exchange allows fans to directly exchange tickets at the original purchase price. This helps fans recoup costs when plans change and enables others to buy secondary tickets without inflated prices. Since its launch, dozens of artists, including Billie Eilish, Hozier, Noah Kahan and more, have used it to facilitate fan-to-fan ticket trading while deterring scalpers. Face Value Exchange is proven to keep ticket prices lower for fans. To ensure this, artists typically limit how tickets can be transferred to prevent scalper exploitation. Unfortunately, lobbyists for the secondary market have successfully helped pass laws in six states – Colorado, Connecticut, Illinois, New York, Virginia and Utah – that prevent artists from mandating face-value resale.

- Verified Resale: Ticketmaster’s Verified Resale tool ensures that fans can buy and sell tickets with confidence. By verifying the legitimacy of each ticket, Ticketmaster’s resale platform reduces fraud and provides a secure marketplace for secondary sales.

- NFL Ticket Exchange: Ticketmaster developed and powers the NFL Ticket Exchange, an open ticketing platform serving as the League’s hub for buying and selling NFL game tickets. Other resale sites can participate if they comply with the NFL’s resale terms, with Ticketmaster verifying each ticket to ensure a secure, fraud-free marketplace.

- Digital Transfer: Launched in 2012, digital transfer simplifies the process of transferring tickets between fans. By utilizing secure digital methods, this technology ensures that tickets can be easily and safely transferred between fans without the risk of duplication or fraud.

- Ticketmaster Continuously Invests In Innovation: We have pioneered a range of technologies and tools to empower artists and make shows more accessible to fans. We invest in these technologies to protect the artist-fan connection as the artist intended it to be. Our goal is to keep tickets from scammers who are looking to intercept tickets meant for the artist’ followers so they can sell them for massive profits on the resale market.

2010

License its Ticketing Software

• Ticketmaster required to license its ticketing software to Anschutz Entertainment Group (AEG). Ticketmaster divested its Paciolan business, which provides software for college sports venues to sell tickets.

2012

Digital Transfer

• Enables free and secure movement of tickets between fans

2017

Digital Ticketing

• Provides more flexible and secure mobile ticket to fans

Improved Abuse Tooling

• Real-time tracking to prevent bots from making purchases over ticket limits

2018

Verified Fan

• New onsale mechanism to help artists sell tickets to fans at artist-determined price points

Smart Queue & Interactive Seat Map

• Requires verified fans to be logged into their accounts to join virtual queues and purchase tickets; new seat map prevents bots from scripting seat selections

2019

SafeTix

• Prevents fraudulent tickets by eliminating mobile screen shots

Fraud Protection Enhancements

• Adds protections against account takeovers

Defense Mechanisms

• Advance analytics to prevent bots from blocking inventory reserve abuse

2020

Face Value Exchange

• Offers artists an option to prevent resale above face value without fees to fans

SmartEvent

• Introduces contactless entry, social distance seating, and other solutions for safe re-opening of live events

2021

NFT Marketplace

• Rewards fans with free NFTs that can be shared, posted and resold

MFA Identity Checks

• Requires fans to provide 2+ verification factors to authenticate account

2022

Edge Blocks

• Protects perimeter of systems to prevent site-wide access by bots

Phone Uniqueness

• Ensures only one account per phone number

Legislative Advocacy

Live Nation Entertainment has been actively involved in legislative advocacy. Our core areas of focus include:

Artist Support

- Ensuring artists’ visas do not become cost prohibitive so that the U.S. can continue to attract top global talent.

- Support of the RAP Act federal legislation preventing lyrics from being used as evidence in criminal justice cases.

- Supported FAA reauthorization bill improving and enhancing fan safety at large outdoor gatherings that include concerts and festivals.

Ticketing Reforms

- Allowing artists to determine how their tickets can be resold.

- Better enforcement of existing anti-bot legislation and new penalties for violations

- Banning speculative ticket selling and deceptive sites that deceive consumers.

- Mandating national all-in pricing so fans can see the full cost of their tickets at the start.

- Live Nation supports currently proposed federal legislation including the House TICKET Act, as well as the Senate TICKET Act and Fans First Act which cover some, but not all, of these reforms.

EXPERT ANALYSIS On the Industry, Ticketmaster & Reforms

The Truth About Ticket Prices

Bob Lefsetz, music industry expert

“Ticket prices have nothing to do with Ticketmaster. If anything, a remedy will help other promoters, who will be able to participate in ticket resale by using another platform. But if you think any change is going to trickle down to the consumer, you’re delusional.” read more

How to Fix the Market for Event Tickets

Eric Budish, Professor of Economics – University of Chicago, Booth School of Business

“The key point I want to emphasize is that what’s NOT A CHOICE is to set a below‐market price, and then just hope and pray that fans will get the mispriced tickets, and there won’t be a fervent secondary market…that’s just a never‐ending cat‐and‐mouse game between the primary market and the brokers. The economically reliable way to get tickets to fans and not have them get resold, is to either set a market‐clearing price in the first place, or to prohibit resale.” read more

Ticketmaster Takes Aim at Resale Sites, Scalpers with ‘Fair Ticketing Act’ Proposal

“Pushing for a “Fair Ticketing act,” Live Nation — owner of both the eponymous live music promoter as well as ticketing giant Ticketmaster — is advocating for federal laws that could weaken scalpers’ ability to mark up ticket prices and gouge customers for in-demand concerts…protecting artists’ ability to decide how their tickets can sell on the secondary market.” read more

Everyone hates Ticketmaster. Is everyone wrong?

August Brown, Music Writer

“There are likely no fixes beyond raising prices, adding more dates or shutting off secondary markets.” read more

Everyone hates Ticketmaster. Is everyone wrong?

Jonathan Daniel, an artist manager for Fall Out Boy and Green Day

“If Ticketmaster gets regulated, you’ll invite some new problems, because Ticketmaster solved a lot of them.” read more

Why are tickets so much cheaper in Europe?

Dave Brooks, Senior Director of Live Music & Touring, Billboard

“The reason for the huge difference in price, experts say, is due in part to longstanding consumer skepticism about resale tickets in most of Europe. That’s coupled with a much more aggressive regulatory environment where artists and consumers are empowered to report and remove illegal ticket listings, and where prices are kept low thanks to laws limiting how high tickets can be marked up over face value. ‘The European approach is significantly different from that of the United States, where ticket resale is not regulated and deceptive marketing practices, including the use of deceptive websites and speculative ticket listings, continue unabated despite widespread outcry from consumers.’” read more

Ticketmaster fees: ‘There’s a real lack of understanding,’ analyst says

Brandon Ross, LightShed Partners Media and Technology Analyst

“So the venues are taking 75%-plus of that fee, and Ticketmaster only 25%. And I don’t think most fans actually understand that.” read more

On Pricing

Full Rate No Cap

Bill Werde, Bandier Program Director, Newhouse School, Syracuse University

“Almost none of this is determined by Ticketmaster. The artist determines if they want to use dynamic pricing. The artist sets the prices. And the artist can insist on using a combination of Verified Fan and Face Value Ticket Exchange to ensure that there is no scalping, as Pearl Jam succeeded in doing on their last tour. The only markets where Pearl Jam could not control this is in the markets where States have passed well-intentioned, but horribly misguided laws “protecting” consumers—laws that ban placing limits on resale.” read more

Bruce Springsteen Breaks Down His R&B Covers LP — and Responds to Fan Outrage Over Ticket Prices

Andy Greene, Senior Writer, Rolling Stone

“But ticket buying has gotten very confusing, not just for the fans, but for the artists also. And the bottom line is that most of our tickets are totally affordable. They’re in that affordable range. We have those tickets that are going to go for that [higher] price somewhere anyway. The ticket broker or someone is going to be taking that money. I’m going, ‘Hey, why shouldn’t that money go to the guys that are going to be up there sweating three hours a night for it?’

“It created an opportunity for that to occur. And so, at that point, we went for it. I know it was unpopular with some fans. But if there’s any complaints on the way out, you can have your money back.” read more

The Truth About Ticket Prices

Daniel Wall, EVP Corporate & Regulatory Affairs, Live Nation Entertainment

“Tickets are actually priced by artists and teams…It’s their show, they get to decide what it costs to get in. Fans are also told that service charges are Ticketmaster’s way of raising ticket prices. In fact, Ticketmaster does not set service charges, venues do, and most of the money goes to the venues.” read more

The Truth About Ticket Prices

Bob Lefsetz, music industry expert

“All I can say is we live in a post-truth society. You make up your own facts. Ticketmaster is the devil and they’re taking advantage of those damn acts and you. This might feel right, but it’s patently untrue.” read more

On Regulatory Affairs

'Grossly Negligent:’ Setting The Record Straight on the 2010 Live Nation-Ticketmaster Merger

Daniel Wall, EVP Corporate & Regulatory Affairs, Live Nation Entertainment

“In today’s primary ticketing market, venues are able to organize robust competitive bidding among Ticketmaster, SeatGeek, AXS and others so that if they choose Ticketmaster — the product that a large majority of venues want to buy — they get Ticketmaster at highly competitive prices. Those are simply the facts. And they do not describe a monopolized market.” read more

How Secondary Sites Misuse Antitrust to Protect Their Business

Daniel Wall, EVP Corporate & Regulatory Affairs, Live Nation Entertainment

“If the government wants to take action that genuinely helps consumers – which is to say, fans – it should pass federal legislation, preempting contrary State legislation, giving artists, sports teams and other event organizers clear rights to set the resale rules for their shows.” read me

Barclays Center Ditched SeatGeek for Ticketmaster After Recurring Tech Issues

Dave Brooks, Senior Director of Live Music & Touring, Billboard

“’They just aren’t designed for high-demand ticket sales, like concerts,’ says Arfa, who describes SeatGeek as ‘a secondary ticketing company that dabbles in primary ticket sales’ while Ticketmaster is better built for large sales. ‘There’s things that we have become accustomed to in the music business’ that Ticketmaster does really well, he noted.” read more

Wolfe Research: Analysis - May 6, 2024

Peter Supino, Logan Angress, Devin Brisco, Ronald Song

“We argue that primary ticketing is a natural “winner takes all” market; if a venue/promoter wants to sell tickets it is in their best interest to use the largest platform with the most data, biggest customer database, and best technology, particularly given promoters often need to recoup substantial guarantees made to artists and therefore have little room for error (Live Nation Concerts L/MSD AOI margins). There are also switching costs and operational uncertainties associated with switching ticketers, which causes many venues to stick with the incumbent. However, that does not mean Ticketmaster will not face competition in the event of a split from Live Nation, particularly given the level of competition Ticketmaster faces currently which has only increased since the merger.”

Rothschild & Co: Analysis - May 9, 2024

Ed Vyvyan

“However, if the DOJ did sue for a break-up, we believe it would do so on shaky ground. Not only has the ticketing market become more competitive since Live Nation/Ticketmaster’s 2010 merger, but it is also unclear whether fans or venues would benefit. We also see issues with the original Consent Decree.”

LightShed Partners Analysis – April 15, 2024

Brandon Ross, Media and Technology Analyst

“. . . [W]e expect a settlement including an extension of the current consent decree and remedies to address the specific business practices. Such a settlement would likely have a very positive impact on LYV stock, minimally removing a large overhang. Other settlements could be accretive to profits. For instance, it has been speculated that the DOJ could be looking at opening Live Nation amphitheaters to third party promoters. Such a move would likely fill more nights at amps, bringing with it high margin revenue.”

Financial Times – April 18, 2024

“Ticketmaster could well command a better valuation as a standalone company. Vivid Seats, a much smaller ticket reselling platform, trades on an EV/ebitda multiple of over 13 times.” read more

Resale Ticketers Reveal True Colors

Taylor Swift’s Tour Is Wreaking Havoc on Ticket Reselling

StubHub said 70% of orders for Taylor Swift tickets on its platform are fan sellers as opposed to professional ticket brokers—double what it normally sees.” read more

Ticket Companies Told Biden They’d Stop Hiding Fees. One Company’s Already Skirting That Promise

“SeatGeek committed to all-in pricing on Thursday, but critics say the company has avoided the policy even in New York where it’s the law” read more

The Year of the $1,000 Concert Ticket

“The average resale price for concert tickets on SeatGeek has more than doubled since 2019, from $125 to $252 so far in 2023. For sold-out acts such as Taylor Swift, Beyoncé and Bruce Springsteen, that number jumps to $1,311, $480 and $469, respectively, the company says.” read more

Beyoncé Tickets Aren’t on Sale Yet. Scalpers Are Trying to Sell Them for Thousands

Ethan Millman, Staff Writer, Rolling Stone

“Scalpers are listing tickets they have no claim to — typically at a marked-up price when the event is in high demand — looking for a fan to buy the speculative listing while they get the actual ticket and pocket the difference.” read more